At a Glance

Injection molding equipment shipments increased 30% quarter-over-quarter, while extrusion equipment declined.

Automotive sector recovery boosted injection molding demand, while construction slowdown hurt extrusion equipment sales.

Interest rate cuts by Federal Reserve expected to improve equipment demand in coming quarters.

North American plastics machinery shipments reached $303.2M in the third quarter of 2025 — a 19.5% increase from both the previous quarter and the same period last year, according to the latest Committee on Equipment Statistics (CES) report released by the Plastics Industry Association (PLASTICS).

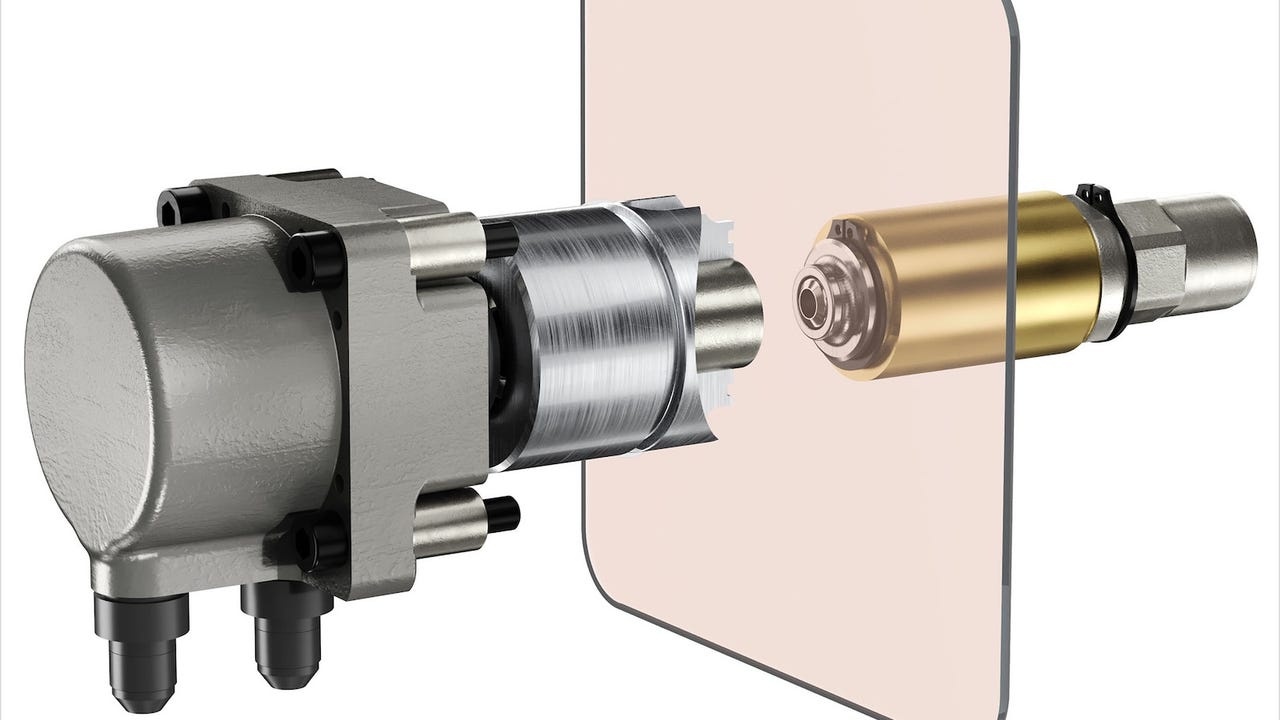

The surge was driven primarily by injection molding equipment, which posted impressive gains of 30.0% quarter-over-quarter and 4.2% year-over-year. However, the industry faced a tale of two markets, as extrusion equipment shipments declined across both timeframes.

PLASTICS Chief Economist Perc Pineda, PhD, who authored the report, said the increase in plastics machinery shipments in the third quarter was driven by the robust increase in injection molding shipments of 30% from the previous quarter and 4.2% from a year earlier.

"Shipments of extrusion equipment, however, decreased quarter-over-quarter and year-over-year," he said. "Single-screw extruders decreased 4.9% from the previous quarter and dropped 24.2% year-over-year. Twin-screw extruders fell 28.9% and 38.6% Q/Q and Y/Y, respectively."

Extrusion equipment & headwinds

The extrusion sector struggled throughout the quarter, with single-screw extruders falling 4.9% from the previous quarter and dropping 24.2% year-over-year. Twin-screw extruders performed even worse, declining 28.9% quarter-over-quarter and 38.6% year-over-year.

Pineda attributed the divergent performance to sector-specific challenges.

"Although shipments continued to increase in the third quarter, it is obvious that both processes faced different headwinds during the quarter," he wrote in the report. "Sector-specific drivers were at play, causing injection molding shipments to rise while those for extrusion fell. Both equipment types were in different cycles."

Residential construction remained flat to slightly down due to persistently high interest rates, which continued to cap growth in plastics production for extruded construction supplies. Industrial production of construction supplies peaked in April with a 2.4% year-over-year increase before declining over the past 12 months.

Automotive sector & recovery

In contrast, motor vehicles and parts production have been trending upward since January, providing a boost to injection molding equipment demand. According to the report, this automotive recovery has been a key driver of the injection molding segment's strong performance.

The Federal Reserve's monetary policy shifts are expected to provide additional tailwinds, according to the report.

"The 50-basis-point interest rate cuts by the Federal Reserve this year — and the market pricing in additional cuts in 2026 — have set the tone for lower borrowing costs ahead, which will eventually feed into plastics manufacturing and lead to higher equipment demand," Pineda added.

Trade deficit widens amid import decline

US plastics machinery trade data for July — the latest available due to government shutdowns — revealed a mixed picture. Pineda explained that exports totaled $112.5 million, while imports reached $336.1 million, resulting in a $223.5 million trade deficit.

Compared to the previous year, Pineda noted that exports decreased by 1.6%, while imports fell significantly by 39.1%. Despite the import decline, the trade deficit rose 75.6% in July from the same month last year.

The third-quarter survey of CES members revealed measured optimism about future market conditions. The report noted that 52% of respondents expected market conditions to remain steady or improve over the next 12 months, slightly lower than the 58% recorded in the previous quarter.

However, quoting activity showed improvement, with 81% of respondents reporting that activity held steady or improved — up from 76% in the previous quarter and marking the second consecutive quarter of increase, according to the report.

Economic outlook remains positive

Trade and tariff concerns persist as potential headwinds.

"Trade and tariff issues remain a concern, yet markets appear to be adapting to this evolving landscape, which hinges on US policy shifts and outcomes from trade talks with key partners," Pineda wrote.

According to the report, the divergent performance between injection molding and extrusion equipment reflects broader economic trends, with automotive manufacturing recovery offsetting construction sector challenges. As interest rates continue to decline and economic growth remains robust, the plastics machinery sector appears positioned for continued expansion, albeit with sector-specific variations likely to persist.

Despite data delays caused by government shutdowns, economic indicators point to continued growth.

"While the government shutdown has delayed the release of economic data, the Federal Reserve Bank of Atlanta's GDPNow estimate for third-quarter growth — as of November 5 — stands at 4%," Pineda concluded.